US Housing Market 2026: New Home Sales Decline 7%

Anúncios

Latest developments on the Current Status of the United States Housing Market in Late 2026: A Deep Dive into the 7% Decline in New Home Sales Nationally., with key facts, verified sources and what readers need to monitor next in Estados Unidos, presented clearly in Inglês (Estados Unidos) (en-US).

The Current Status of the United States Housing Market in Late 2026: A Deep Dive into the 7% Decline in New Home Sales Nationally. is shaping today’s agenda with new details released by officials and industry sources. This update prioritizes what changed, why it matters and what to watch next, in a straightforward news format.

Anúncios

Understanding the 7% Decline in New Home Sales

The United States housing market is currently navigating a significant downturn, marked by a national 7% decline in new home sales as of late 2026. This contraction is sending ripples across the entire real estate sector, affecting builders, prospective homeowners, and the broader economy.

This percentage drop reflects a cooling trend that has been gradually building over the past year, intensifying in recent months. Analysts are scrutinizing various macroeconomic factors and policy decisions that have contributed to this notable shift.

Understanding the nuances of this decline is crucial for anyone involved in or impacted by the housing market. It signals a potential recalibration of market dynamics, demanding careful consideration of investment strategies and purchasing decisions.

Anúncios

Macroeconomic Factors Driving the Downturn

Several macroeconomic forces are converging to exert downward pressure on the US Housing Market 2026. Rising interest rates have significantly increased the cost of borrowing, making mortgages less affordable for a substantial portion of potential buyers.

Inflationary pressures continue to erode consumer purchasing power, further dampening demand for large investments like new homes. Economic uncertainty, fueled by global events and domestic policy shifts, also contributes to a cautious sentiment among consumers.

These overarching economic conditions create a challenging environment for new home sales. The interplay of these factors suggests a complex landscape that requires more than a singular solution to stabilize the market.

Interest Rate Hikes and Affordability

The Federal Reserve’s aggressive stance on interest rate hikes throughout 2025 and into 2026 has directly impacted mortgage rates. This has priced out a segment of buyers who could previously afford new construction.

Affordability remains a critical barrier, with the median home price still elevated despite the sales decline. The higher monthly mortgage payments mean that even a slight increase in rates can significantly reduce a buyer’s eligible loan amount.

- Mortgage rates at multi-decade highs directly impact buyer eligibility.

- Increased monthly payments reduce the pool of qualified buyers.

- First-time homebuyers are particularly affected by affordability constraints.

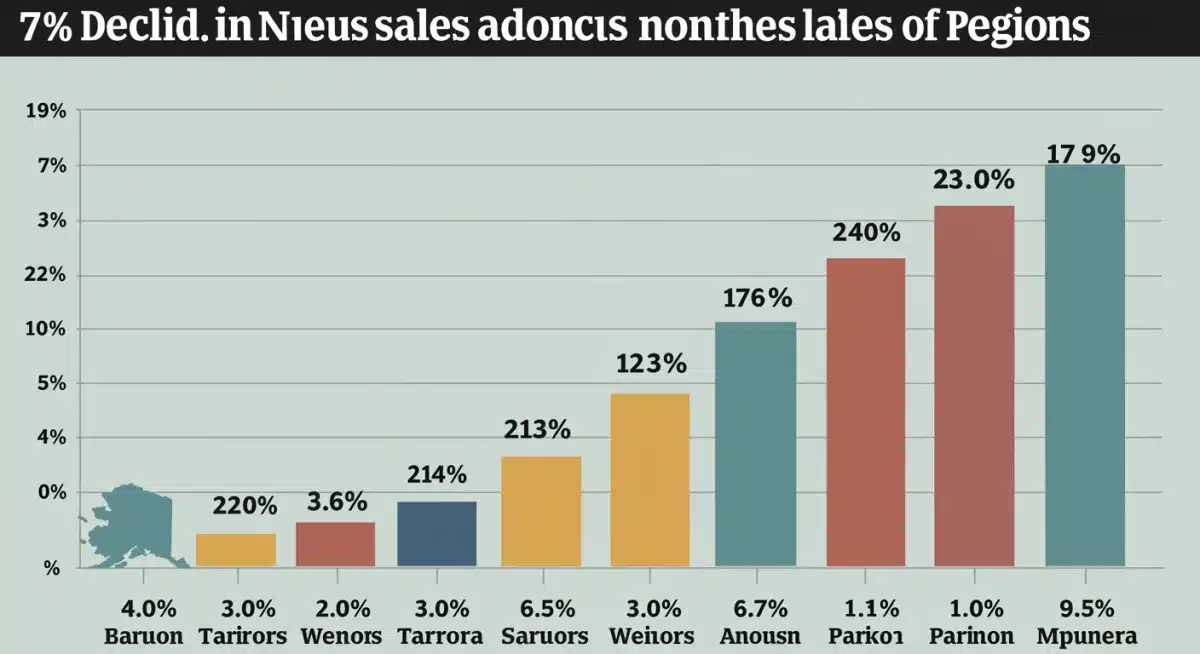

Regional Disparities in New Home Sales

While the national average shows a 7% decline, the impact is not uniform across all regions of the United States. Certain metropolitan areas and states are experiencing sharper drops, while others show more resilience or even minor growth.

The Sun Belt states, which saw a boom in population and construction during the early 2020s, are now witnessing some of the most significant adjustments. Conversely, some established markets with stronger underlying economic fundamentals are weathering the storm more effectively.

This regional variation highlights the localized nature of real estate markets, even within a broader national trend. A detailed examination of these disparities provides a more granular understanding of the US Housing Market 2026.

Impact in Sun Belt States

States like Florida, Texas, and Arizona, which experienced rapid expansion and high demand, are now seeing a more pronounced slowdown. Overbuilding in certain areas during the boom years is now contributing to an excess supply.

The influx of remote workers during the pandemic had fueled much of the growth in these regions. As companies recall employees to offices or economic conditions shift, this demand driver is softening.

- Rapid construction led to increased inventory in some Sun Belt markets.

- Reduced inbound migration impacts demand in previously booming areas.

- Local economic conditions play a significant role in market resilience.

Builder Sentiment and Construction Activity

The decline in new home sales is having a direct and measurable effect on builder sentiment and, consequently, on new construction activity. Many builders are reporting decreased confidence in the market, leading to a slowdown in new project starts.

Supply chain disruptions, though easing, combined with higher material and labor costs, continue to pose challenges for builders. This confluence of factors makes it difficult to maintain profitability in a contracting sales environment.

The cautious approach from builders means fewer new homes will enter the market in the immediate future, which could have long-term implications for housing supply. This impacts the overall health and future trajectory of the US Housing Market 2026.

Adjustments in New Project Starts

Data from the National Association of Home Builders (NAHB) indicates a marked decrease in housing starts and building permits. This reflects a strategic pullback by builders in response to lower demand and increased uncertainty.

Some builders are offering incentives, such as mortgage rate buydowns or price reductions, to move existing inventory. However, these measures may not be enough to offset the broader market headwinds.

The reduction in new project starts is a lagging indicator that confirms the severity of the sales decline. It suggests that the market will likely experience a period of reduced construction activity.

Implications for Existing Homeowners and Buyers

The 7% decline in new home sales also has significant implications for existing homeowners and those looking to purchase a resale property. A cooling new home market can indirectly affect the broader housing landscape by influencing pricing and inventory levels.

Existing homeowners may find their property values stabilizing or even declining in some areas, particularly if they are in markets with a high concentration of new construction. Buyers, on the other hand, might see increased opportunities but still face high interest rates.

Navigating this evolving market requires careful strategy for both sellers and buyers. Understanding the flow-on effects from new home sales is key to making informed decisions in the US Housing Market 2026.

Market Dynamics for Resale Properties

While new home sales are distinct, their decline can lead to an increase in inventory in the resale market as potential buyers pivot. This creates more options for buyers, but also more competition for sellers.

Sellers of existing homes may need to adjust their price expectations to compete with new construction offerings, especially those with builder incentives. The overall market sentiment also plays a role in how quickly existing homes sell.

Buyers of resale properties might find themselves in a stronger negotiating position than in previous years. However, the high mortgage rates remain a persistent challenge, regardless of the type of home being purchased.

Government Policies and Future Outlook

Government policies, both monetary and fiscal, will play a crucial role in shaping the future trajectory of the US Housing Market 2026. Decisions by the Federal Reserve regarding interest rates and government initiatives to address housing affordability could significantly alter current trends.

There is increasing pressure on policymakers to intervene with measures that could stimulate demand or alleviate supply constraints. However, balancing these interventions with broader economic stability goals presents a complex challenge.

The outlook for the housing market remains uncertain, contingent on these policy decisions and the overall economic performance. Stakeholders are closely watching for any signals of a shift in strategy that could impact the 7% decline in new home sales.

Potential Policy Interventions

Discussions are underway regarding potential government programs to assist first-time homebuyers, such as expanded down payment assistance or tax credits. These measures could help re-engage a segment of the market that has been sidelined by affordability issues.

Regulatory changes aimed at streamlining the permitting process for new construction could also help reduce costs for builders and potentially increase housing supply. However, the implementation of such changes can be slow.

The effectiveness of any policy intervention will depend on its scope, timing, and integration with existing economic conditions. A coordinated approach is essential to address the multifaceted challenges in the US Housing Market 2026.

Expert Analysis and Market Predictions

Leading real estate economists and market analysts are offering varied predictions for the remainder of 2026 and beyond. While there’s a consensus on the current slowdown, opinions diverge on the speed and nature of a potential recovery.

Some experts foresee a gradual stabilization of the market as inflation cools and interest rates potentially plateau or even slightly decrease. Others warn of a prolonged period of subdued activity, especially if economic growth falters.

These analyses provide critical context for understanding the US Housing Market 2026. They help buyers, sellers, and investors prepare for different scenarios and adapt their strategies accordingly.

Forecasts for 2027 and Beyond

Looking ahead to 2027, many analysts predict that affordability will remain a key determinant of market health. The trajectory of inflation and interest rates will continue to be the most influential factors.

The long-term outlook also considers demographic trends, such as the entry of younger generations into the homeownership market. Their ability to purchase will be crucial for sustained recovery.

A significant rebound in new home sales is not widely anticipated in the immediate future, with most forecasts suggesting a gradual path to recovery. The US Housing Market 2026 decline sets the stage for a cautious but potentially more balanced market in the coming years.

Challenges for Home Builders and Developers

The 7% decline in new home sales presents substantial challenges for home builders and developers across the nation. Reduced demand directly impacts their revenue streams and necessitates adjustments in their business models and future planning.

Many developers are now facing increased inventory of unsold homes, leading to carrying costs and potential price reductions to clear stock. This situation can strain financial resources and lead to project delays or cancellations.

Navigating this environment requires strategic agility, including exploring new financing options and diversifying product offerings. The health of the construction sector is intrinsically linked to the overall vitality of the US Housing Market 2026.

Strategies for Adapting to Market Shifts

Builders are implementing various strategies to adapt to the current market conditions. This includes focusing on more affordable housing segments, offering enhanced incentives, and exploring build-to-rent models to diversify their portfolios.

Technological advancements in construction, such as modular building, are also being considered to reduce costs and construction timelines. This could make new homes more competitive in a price-sensitive market.

- Exploring more cost-effective construction methods.

- Offering buyer incentives like rate buydowns or closing cost assistance.

- Diversifying into rental communities to offset sales downturns.

| Key Point | Brief Description |

|---|---|

| New Home Sales Decline | National 7% drop in new home sales by late 2026, signaling market cooling. |

| Affordability Challenges | High interest rates and inflation make homeownership less accessible. |

| Regional Variations | Impact uneven, with Sun Belt states seeing sharper declines. |

| Builder Sentiment | Decreased confidence leading to reduced construction starts and incentives. |

Frequently Asked Questions About the US Housing Market

The decline is primarily driven by rising interest rates, which increase mortgage costs, and persistent inflation eroding consumer purchasing power. Economic uncertainty and tighter lending standards also contribute to reduced buyer demand for new homes across the nation.

While the decline is national, Sun Belt states like Florida, Texas, and Arizona, which experienced significant growth earlier, are seeing some of the sharpest drops. Other established markets show more resilience, indicating regional disparities in the US Housing Market 2026.

Existing homeowners may see their property values stabilize or slightly decline in some areas, especially where there is new construction competition. The overall market cooling can lead to longer selling times and potentially lower offers for resale properties, impacting equity.

Yes, many builders are reducing new project starts, offering incentives like rate buydowns, and exploring more affordable housing options or build-to-rent models. They are adapting to the lower demand and higher costs to maintain viability in the challenging US Housing Market 2026.

The long-term outlook remains cautious, with a gradual recovery anticipated rather than a rapid rebound. Key factors will be the trajectory of interest rates, inflation, and government policies aimed at improving affordability. Demographic shifts will also play a role in future demand.

What This Means for the Future of US Housing

The 7% decline in new home sales nationally in late 2026 underscores a significant shift in the US Housing Market 2026. This contraction is not merely a blip but a clear indicator of evolving economic forces and consumer behaviors. It suggests a period of necessary recalibration, where affordability and interest rates will continue to dictate market activity more than ever before. Stakeholders, from individual buyers and sellers to large-scale developers and policymakers, must remain agile and informed.

Looking ahead, the market’s trajectory will largely depend on the Federal Reserve’s monetary policy and any governmental interventions aimed at stabilizing housing costs. We can anticipate continued regional variations, with some areas recovering faster than others. The focus will likely shift towards more sustainable growth, potentially encouraging innovative solutions in construction and financing to meet future demand.

This period of adjustment offers both challenges and opportunities. For buyers, patience might yield better value, while sellers may need to temper expectations. For the industry, it’s a call to innovate and adapt, ensuring the long-term health and accessibility of the US Housing Market 2026. Monitoring key economic indicators and policy announcements will be paramount in the coming months and years.