Moody’s US credit rating downgrade: Economic Impacts and Consumer Risks in 2025

Anúncios

The Moody’s US credit rating downgrade in 2025 has shaken confidence across Wall Street and beyond. Investors, policymakers, and everyday consumers are now recalculating their expectations in light of this pivotal shift.

A lower credit standing often translates into more expensive borrowing, tighter access to capital, and heightened scrutiny of fiscal policy. These ripple effects extend from government bonds to household loans, touching every layer of the economy.

For individuals, the downgrade is more than a headline, it may reshape mortgage rates, credit card interest, and long-term savings strategies. The question is no longer abstract: it’s how these changes will directly influence your financial future.

Anúncios

Understanding Moody’s credit rating system

Understanding Moody’s credit rating system is crucial to see how global markets interpret financial risk.

The agency evaluates the likelihood of default and the stability of borrowers, whether they are sovereign governments, corporations, or financial institutions.

By providing these ratings, Moody’s offers a benchmark that shapes investment decisions, lending practices, and even policy measures. Without such standardized assessments, investors would face greater uncertainty in evaluating creditworthiness.

Anúncios

Moody’s US credit rating downgrade in 2025 highlighted the weight of these assessments.

When an economy as large as the United States sees its standing lowered, it not only signals potential challenges within the country but also triggers worldwide concern.

This shows how interconnected credit ratings are with global stability, as many financial contracts, bonds, and interest rates depend on these evaluations.

Ultimately, Moody’s credit ratings serve as a compass for market confidence. They allow investors to compare risks across different sectors and regions, making them one of the most powerful tools in global finance.

The downgrade of the US rating is a reminder of how sensitive economies are to these metrics and why understanding them is fundamental for anyone involved in financial planning.

How Moody’s Rates Credit

Moody’s applies a structured scale to classify debt issuers, ranging from the highest grade, Aaa, to the lowest, C. These categories are not merely labels but signals of financial strength or vulnerability.

Aaa indicates minimal risk and strong repayment capacity, while C reflects a very high probability of default. Between these extremes lies a spectrum of ratings that influence borrowing terms, investor confidence, and capital flows.

Ratings such as Baa fall into the medium-quality range. They are considered adequate but carry more uncertainty than top-tier ratings.

Anything below Baa enters speculative territory, often referred to as “junk” status, which makes it difficult for issuers to secure financing without paying significantly higher interest.

This classification system helps standardize how markets perceive risk across different borrowers.

The impact of Moody’s US credit rating downgrade in 2025 illustrates this mechanism in practice. As the US rating shifted downward, interest costs for government bonds increased, and financial markets reacted with caution.

Such changes demonstrate how closely aligned these ratings are with the cost of borrowing, liquidity in financial markets, and broader economic confidence.

The Importance of Credit Ratings

Credit ratings hold a central role in shaping the flow of capital worldwide. They act as a signal for investors deciding where to allocate funds, guiding them toward opportunities with perceived stability and away from those seen as too risky.

For governments, a downgrade means paying more to issue debt, as lenders demand higher compensation for increased uncertainty.

For businesses, the stakes are just as high. Companies with downgraded ratings may find it more expensive to raise capital for expansion, research, or even operational needs.

The downgrade also influences how global investors perceive national economies, which can lead to fluctuations in stock markets and currency values.

Moody’s US credit rating downgrade in 2025 is a clear example of how far-reaching these effects can be.

Consumers are not immune to these shifts. When borrowing costs rise at the national level, households often face higher mortgage rates, costlier loans, and reduced access to affordable credit.

This ripple effect shows how deeply credit ratings are tied to everyday financial realities. Understanding these dynamics empowers individuals and institutions alike to anticipate changes and adapt their financial strategies accordingly.

Implications of the downgrade on the economy

The implications of a Moody’s US credit rating downgrade extend far beyond financial headlines, shaping both domestic and international economic conditions.

When a country as influential as the United States experiences a lower rating, investors interpret this as a warning sign that the government may face greater difficulty managing its debt or sustaining fiscal stability.

This perception alone can trigger volatility in bond markets, weaken investor confidence, and set off a chain reaction that affects nearly every sector of the economy.

A downgrade often leads to higher borrowing costs for the federal government, as lenders demand increased returns to compensate for added risk.

Immediate Market Reactions

The first response is often seen in the financial markets. Investors may become anxious, leading to stock market volatility. A downgrade can trigger sell-offs, causing share prices to drop as confidence wanes.

- Bonds may see increased yields as investors demand higher returns for the perceived risk.

- Government borrowing costs can rise, leading to more expensive loans.

- Consumers may experience higher interest rates on mortgages and loans.

A reduced credit rating not only affects government borrowing but can also ripple through corporate sectors. Companies may find it harder to get favorable loan terms.

Long-term Economic Effects

Over time, a downgrade can lead to economic stagnation. Higher borrowing costs mean less available cash for infrastructure projects or public services. Workers may face layoffs as companies cut back on spending.

Additionally, reduced investment can result in slower job growth. A struggling economy impacts everyone’s financial situation, from individuals to small businesses.

When consumers feel uncertain, discretionary spending declines, affecting overall economic health.

The downgrade sends a message of financial instability that affects confidence across various sectors. Long-term implications can include slower GDP growth and increased unemployment.

Understanding these implications can help individuals and businesses prepare for financial shifts that may arise.

How consumers could be impacted

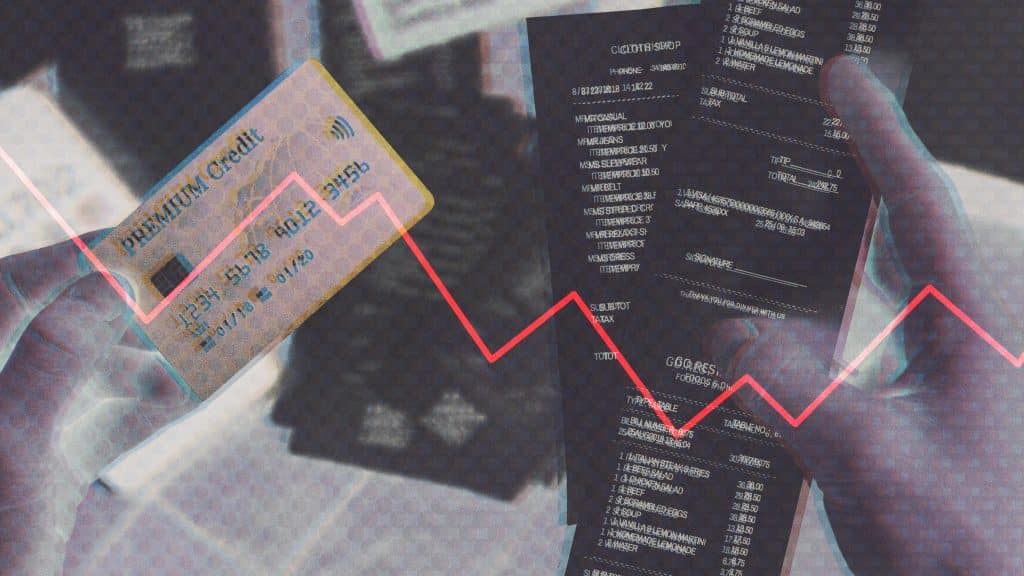

The effects of a Moody’s US credit rating downgrade go well beyond financial markets and can directly reshape household budgets.

For ordinary consumers, the downgrade creates ripple effects that influence everything from the cost of credit to overall financial security.

Understanding these changes is essential for anyone trying to manage personal finances during times of economic uncertainty.

Increased Borrowing Costs

One of the most immediate impacts comes through rising borrowing costs. As the government faces higher interest rates on its debt, lenders transfer this added risk to consumers by raising rates on mortgages, auto loans, and credit cards.

Homeowners with adjustable-rate mortgages may see their monthly payments climb, while new buyers face barriers to homeownership as affordability declines.

Credit card holders are especially vulnerable, as higher rates make it easier for balances to snowball into long-term debt. These shifts reduce disposable income and can limit household spending, directly shaping consumer behavior.

Reduced Consumer Confidence

Additionally, a downgrade can lead to decreased consumer confidence. When people feel uncertain about the economy, they tend to spend less. This shift can impact businesses, leading to lower sales and potentially layoffs.

When uncertainty looms, consumers might delay major purchases. Items like cars and appliances could be put off as individuals focus on saving money instead of spending.

This behavior can create a cycle of economic slowdown, where less spending leads to decreased economic growth.

Job security may also be affected, as companies might cut back on hiring or even lay off employees to manage increased costs. As a result, families may feel pressure to tighten their budgets, making planning for future expenses more challenging.

Understanding these impacts helps consumers navigate financial landscapes that are shifting in response to credit rating changes. Keeping an eye on personal finances becomes even more important during these times.

Reactions from the financial sector

The financial sector often reacts swiftly to news about credit rating downgrades. These reactions can shape market sentiments and influence investment strategies significantly.

Following a downgrade, stock prices of affected companies can drop as investor confidence wanes. This instability can lead to a ripple effect across the market.

- Investors typically sell off stocks, concerned about the potential for economic slowdown.

- Bank stocks, in particular, may see declines due to fears of rising default rates.

- Bond markets may become volatile, affecting yield curves and investment strategies.

Such reactions create a cautious environment, where financial institutions reassess risk and adjust their portfolios accordingly.

Banks and institutions often tighten their lending practices in response to increased risk perception. They may raise interest rates on loans or impose stricter borrowing criteria.

This tightening affects both businesses seeking loans and consumers looking for mortgages or personal loans.

Additionally, financial analysts and experts often increase their scrutiny of the affected sectors and revise growth forecasts. Investors may see new recommendations reflecting the heightened risk.

However, some investors view these downgrades as opportunities. They may consider buying undervalued assets that could rebound in the long run.

This counter-response illustrates the dynamic nature of the market and the differing strategies employed by investors.

Overall, understanding the reactions from the financial sector helps consumers and investors navigate through uncertain economic conditions, promoting informed financial decision-making.

Future outlook and recovery strategies

The future outlook following a credit rating downgrade can seem uncertain, but there are viable recovery strategies. Understanding what comes next is essential for both consumers and investors.

Economy Recovery Trends

Typically, the economy will undergo a period of adjustment after a downgrade. Recovery often depends on various factors, including government response and market reactions.

Economists predict that if the government implements effective fiscal policies, there may be paths to recovery.

Investments in infrastructure can play a vital role in stimulating economic growth by creating jobs and improving productivity. At the same time, policies that encourage consumer spending help boost demand, ensuring businesses remain active and markets stay dynamic.

Complementing these efforts, monetary policy adjustments such as lowering interest rates can make lending more accessible, giving both individuals and companies greater flexibility to invest and expand.

Ultimately, a proactive approach can help restore confidence and foster economic recovery.

Strategies for Individual Investors

For individual investors, diversification is key. This strategy helps mitigate risks tied to market volatility. Investing in a mix of assets, including stocks, bonds, and real estate, can provide a buffer.

Monitoring market trends is equally important. Staying informed allows investors to make timely decisions. They should look for undervalued stocks from companies likely to rebound after a downgrade.

Additionally, considering sectors that typically perform well during economic downturns can lead to smarter investment choices.

Engaging with financial advisors can provide personalized strategies for navigating these uncertain times. Aligning investment goals with changes in the economic landscape is crucial for long-term financial health.

By understanding potential recovery paths and adopting effective strategies, both consumers and investors can better prepare for the aftermath of a downgrade.

What did you think of the content? Continue on our website and read more Healthcare cost deductions Gen Z.

FAQ – Frequently Asked Questions about Moody’s US Credit Rating Downgrade 2025

What happens to borrowing costs after a credit rating downgrade?

After a downgrade, borrowers often face higher interest rates on loans and mortgages due to increased risk perception among lenders.

How does a credit rating downgrade affect consumers?

Consumers may experience reduced confidence, leading to decreased spending and potential financial strain from higher borrowing costs.

Are there investment opportunities during a downgrade?

Yes, some investors see downgrades as opportunities to buy undervalued assets that are likely to rebound as the economy stabilizes.

What strategies can I adopt to mitigate risks?

Diversifying your investment portfolio and staying informed about market trends can help manage risks during economic uncertainties.